Why am I renting when the rent just pays for my landlord’s mortgage?

If I buy, at least my money goes to my mortgage and I’m busying an asset, right?

Why are real estate investors renting? Isn’t it better to buy?

This is the age old debate. People have been debating this for years.

Let me start by saying that there’s no right or wrong answer. Is it better to rent or is it better to buy? Is one better than the other?

Well… it depends.

What do I mean?

Let me lay out some pros and cons for renting and buying below

RENTING

Pros:

- Flexibility: Similar to leasing a car, you can switch places every year or few years. You’re not locked in to a mortgage.

- No need for a down payment: If you’re renting, you don’t need to save up for a large down payment to buy a place, just need to come up with your monthly rent. Real estate investors often rent and use their home as an office and claim it as a business expense, then use the money that they would have used as a down payment to invest in real estate deals.

- Maintenance: As a tenant, you’re typically not responsible for repairs of fixtures in the property. If your stove breaks or your faucet is loose, it’s the landlord’s responsibility to pay for that. As a tenant, sometimes the landlord pays for utilities too and so you don’t have much expenses as a tenant.

- Low rents: Landlords are notorious for not charging market value rents in order to reduce the risk of tenants leaving. They are also notorious for not raising rents. This means that tenants often pay below market value rents for years.

- No strata fees or property taxes: Tenants are not responsible for strata fees or property taxes.

Cons:

- You’re paying someone else’s mortgage: As a tenant, your rent goes to the landlord’s pockets, usually it goes to pay the mortgage.

- Landlord can kick you out: If the landlord wants to sell or perform a severe renovation, you may be left with no choice but to find a new place to live.

- You have to abide by Landlord rules: Landlords may implement certain rules for what you can or cannot do when living on their property. Remember, you’re renting the home, you don’t own it.

BUYING

Pros:

- You own your home: Many people love the feeling of owning something. They don’t lease a car, they buy one. They don’t rent a home, they buy one. The love the ownership feeling.

- Equity and Appreciation: Not only does your mortgage go towards the equity in your property, but you get to take advantage of the asset appreciation as well.

- Flexibility: When you buy a home, you are able to use it as a vehicle to generate income. When your home has a certain amount of equity, you can take a home equity line of credit to access the home’s equity and use it towards other investments. You can rent out your property and have the tenant pay for your mortgage while you buy another property. You can rent out rooms in your home while you live in the property and the rent will help subsidize or even pay your whole mortgage payment.

Cons:

- Need a large down payment: Not everyone can come up with a large down payment in order to get a loan from the bank.

- You’re buying a liability: Ever read the book, “Rich Dad, Poor Dad” by Robert Kiyosaki. One of the key concepts he talks about is that your house is not an asset. He explains that an asset is something that gives you every month and a liability is something that takes money from your bank account every month. When you buy a home, a common misconception is that people think they’re buying an asset. Your home doesn’t give you money every month. Actually it takes money out of your pocket every month in the form of a mortgage payment, strata fees, property taxes, home insurance, etc… When you sell the home and if you make a profit, then at that point it becomes an asset. Or, if you buy the home as a rental investment property and the rent you collect is greater than the expenses, then it is considered an asset.

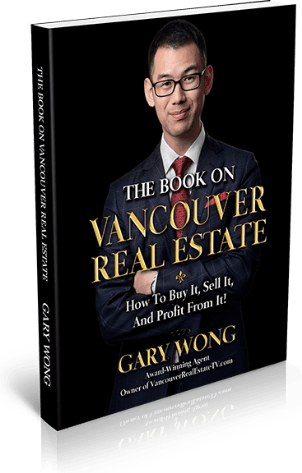

I can talk for hours about this, but I hope the few points above give you a brief understanding of this topic. I go into more detail in my book, The Book on Vancouver Real Estate. Feel free to contact me for a copy or if you have any questions regarding this topic.

Yvonne Yang

Yvonne Yang

Carlos Garcia

Carlos Garcia

Achieve your real estate dreams effortlessly with us, where exceptional results and dedicated support are our promise to you.